Shopper

FYI

Sharing stories

A trove of insights, information, and ideas.

Shopper

DIY

Navigating success

A comprehensive how-to guide, including tools and templates

RESEARCH REPORTS

What's next for Shopper strategy?

What will it take to get from 'good' to 'great"?

The state of Shopper today is good. This sweeping assessment is crystallized in the response to a single survey question, in which our respondents were asked to “rate the overall shopping experience provided by your brand.” The average response was 3.2 stars out of 5.

The state of Shopper today is good. This sweeping assessment is crystallized in the response to a single survey question, in which our respondents were asked to “rate the overall shopping experience provided by your brand.” The average response was 3.2 stars out of 5.

Three stars is “good.” It’s fair to ask, though, what will it take to move Shopper from “good” to “great”?

Many of the issues standing in the way are familiar: A lack of training, funding, and measurement. These challenges have shown up in a big way in our surveys for at least the last four years, and certainly to some degree since Shopper burst on the scene a dozen or more years ago. Shaky communications with the brand team, and conflicting goals and timelines between Sales, Marketing and Shopper, also stubbornly pock the landscape. These apparently intractable issues, and more, play out in a variety of ways in the responses to our latest survey’s questions.

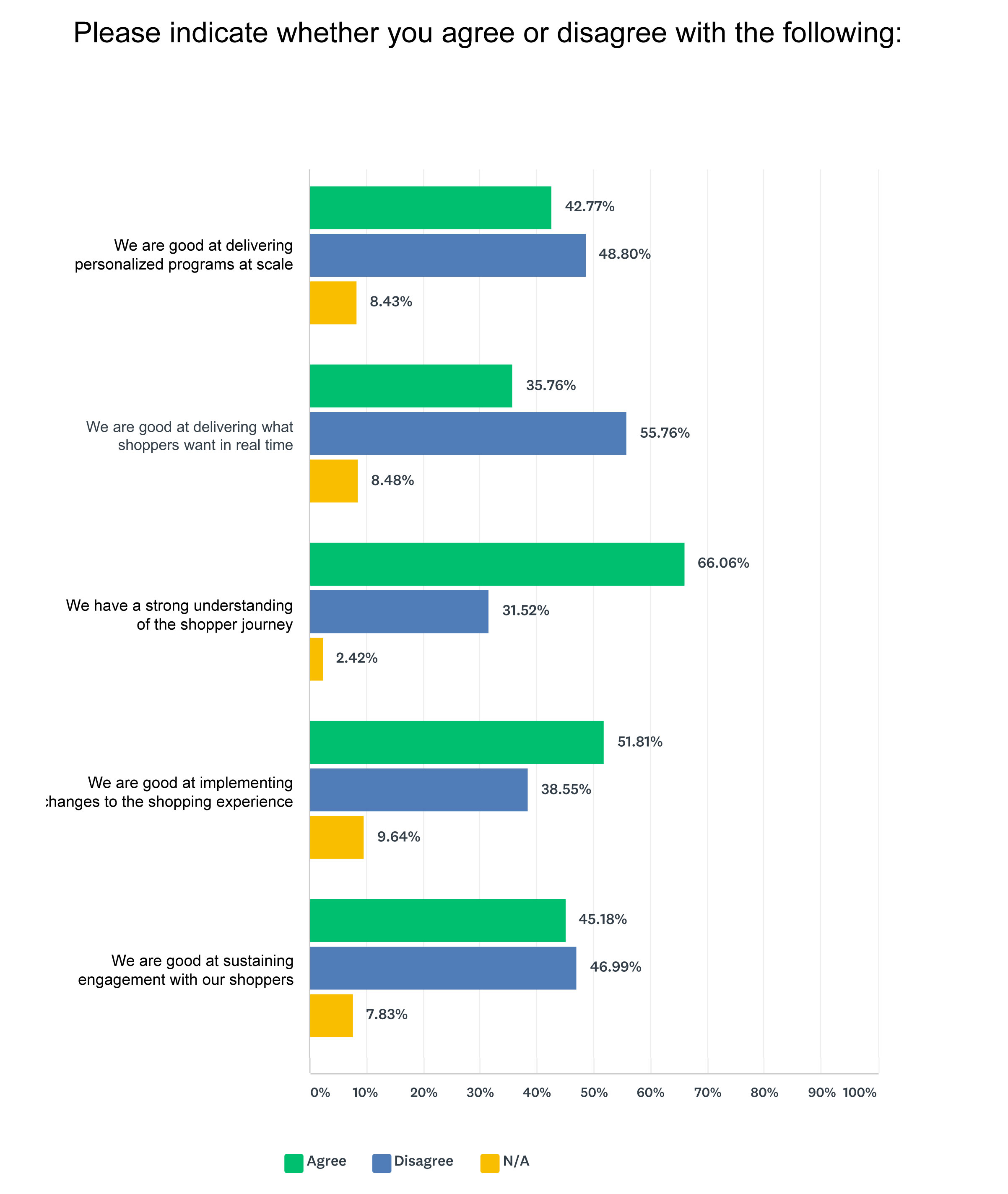

Shopper’s efforts to personalize at scale seem to be falling a bit short, for example, as is its capacity to respond to shopper needs in real-time. Only by the narrowest of margins did respondents claim success at sustaining engagement with shoppers. Arguably, these should be core Shopper competencies and point to key areas in need of attention.

Yet a certain level of confidence is evident. Most say they have a good understanding of the shopper journey and are good at making changes to the shopping experience. While a razor-thin plurality of 42.73% rate Shopper success as “good,” a nearly equal percentage of 42.29% say it is either “very good” (33.04%) or “excellent” (9.25%). A number of respondents cite the rise of digital commerce as an opportunity for Shopper. About half say Shopper leads in digital innovation. Some perceive digital as a potential threat to Shopper, at least in terms of budgets, however.

Lurking in the background, meanwhile, is the possibility that digital’s rise could help trigger a renaissance in old-fashioned, in-store shopping experiences, and with it more opportunities for Shopper to show its full potential as a strategic platform for commercial innovation in stores. Sixty-seven percent see Shopper as a platform for innovation, and 30% view “innovation” as their brand’s greatest strength relative to Shopper, second only to “implementation,” at 36%.

The overarching imperative is for Shopper to cross the great divide from garden-variety tactics to blue-sky innovation. This transition can happen in a variety of ways.

From marketing to real life. Where Advertising is the business of communicating promises, Shopper is the business of delivering on those promises. It is where lifestyle aspirations meet the realities of in-the-moment choices, the unique nexus of where brand stories are told and the cash register rings.

From functional to purposeful. Every brand and retailer has one paramount purpose: their consumers. Shopper delivers on that promise by knowing their consumers well enough to know what to deliver based on when, where and why they shopping.

From discounts to solutions. Discounts are a dime a dozen, but solutions require a fundamental understanding of what it is our shoppers would like to accomplish at any -- and every -- given moment.

From categories to curated. Retailers have premised their business models on category management. Maybe retailers — and their packaged-goods partners — should rethink their mutual paradigm in terms of category curation. Perhaps, for example, what people would like is not necessarily a prepared meal, but a retail experience that is organized based on preparing meals.

From ‘on-again, off-again’ to ‘always on’. Historically, the individual initiatives that roll up into a long-term Shopper strategy have been discrete pockets of activity, with defined start and stop dates. The future might be a continuous platform that engages and activates shoppers, and provides solutions to their problems on some basic level, 52 weeks a year. “We need to be there when they’re ready to shop, not just around one big promotion,” says Debbie Zefting of Barilla.

From quick trips to slow shopping. It’s pretty much an article of faith that the longer shoppers shop, the more money they spend. Especially in world where the big, stock-up trip is being replaced by smaller, serial, quick trips, retailers and their packaged-goods partners should seize the opportunity to slow the pace, and find ways to keep and hold shoppers in their stores.

From one-dimensional to five-dimensional. Shopper can take full advantage of the opportunity to immerse shoppers in an experience that touches all the senses: not just sight and sound but also smell, touch and taste. A dedicated effort to create a more sensory experience promises to yield greater engagement, and with it shopper loyalty and profits for both retailers and their brand-owner partners.

From limited-time offer to lifetime value. While short-term measures are important, Shopper’s true contribution is to the lifetime value of the relationships it builds by anticipating and solving shopper problems, aligning with their aspirations, and making people’s daily lives better and happier in ways big and small.

Special thanks to Mike Clifford of Kellogg's; Brian Sullivano of Georgia-Pacific; Matt Parry of Walmart; Debbie Zefting of Barilla USA; Alysia Ross of Danonewave, Dina Keenan of New Seasons Market, Barry Roberts and Tammy Brumfield for their keen insights into the future of Shopper. Thanks also to Nancy Swift, Chris Hoyt and Al Wittemen for their guidance and support.

PREVIOUSLY

Can someone please define shopper marketing?

Who cares how shopper is organized?

Are retailer-led programs a problem?

Is there any such thing as a shopper insight?

Where are shopper agencies falling short?

Is there a cure for marketing mix modeling?

Should ‘shopper marketing’ be re-named?

MANIFESTO

CONFAB REPORT

Shopper's brand new bag

Innovation, empathy & growth in the age of commerce

It’s sometimes said that “it’s all just marketing.” Perhaps not so much anymore. Arguably, there’s marketing, and then there’s Shopper, which is better understood as a business than a marketing strategy. Shopper is much more about commercial innovation -- that is, making improvements in the way consumers experience brands while shopping -- than it is about marketing in a more traditional sense.

It’s sometimes said that “it’s all just marketing.” Perhaps not so much anymore. Arguably, there’s marketing, and then there’s Shopper, which is better understood as a business than a marketing strategy. Shopper is much more about commercial innovation -- that is, making improvements in the way consumers experience brands while shopping -- than it is about marketing in a more traditional sense.

The Fourth Confab on the Future of Shopper more than underscored the vital role this relatively young discipline plays in an emerging era that thrives on connecting the dots between consumers and shoppers, brands and retailers.

This new phase is premised on the belief that Shopper is not built on sales, marketing, retail or brand tactics alone. Rather, it is grounded in a holistic business strategy that rises on the strength of two defining ideas: 1 – If you don't understand consumers as shoppers, you don't understand consumers. 2 – If you don't actualize brand and retail strategies holistically, you no longer have a brand.

Our five-hour discussion was predicated on a shared belief in Shopper’s pivotal place within the organization at a moment when so many brands have been reduced to commodity status in part because of their ubiquity at retail, both online and in stores. While sometimes dismissed as a grab-bag of discounts and homely, anti-brand promotional gambits, in fact Shopper is a complex business idea based on the alignment of brand and retail goals and objectives, and blending of consumer and shopper insights.

Much of the day’s give-and-take among the 11 participants centered on the indispensable part that Shopper plays within brand and retail organizations. This role largely is a function of Shopper’s unique insights into how consumers behave as shoppers, and why they make the brand decisions the do under a range of circumstances, both emotional and practical. Equally important is Shopper’s singular perspective on the retail environment, and why retailers do what they do.

These factors matter for one simple reason: we now live in an age where brand interactions and transactions are inextricably linked, thanks to that pocket-sized marvel formerly known as the cellphone. As one Confab member pointed out, it’s a period that pretty much began in 2008, with the introduction of the Apple iPhone. As it happens, most Shopper departments were established at around the same time. Almost a decade later, if the transition into this new age of commerce and commercial innovation is not yet complete, it is pretty darn close.

We are now all shoppers, all the time.

The innovation imperative. Shopper’s place in the digital world will depend on an ability innovate, and clearly we are in the very early stages of exploring that potential. Much as brand folks initially viewed digital as a cool new way to deliver advertising messages, some in Shopper at first saw it as a nifty coupon dispenser. Everyone now knows the potential is much larger, given how all things digital so completely permeate everyday life. Shopper's ability to engage and connect emotionally and to inspire is clear, though still underdeveloped.

A unique vantage point. Shopper also occupies a special place within the larger enterprise, which is both a strength and a weakness. Sometimes it is housed within the brand group, which oftentimes underestimates the challenges of connecting with shoppers at retail. Sometimes it resides within sales, which frequently focuses only on the value of short-term promotions. Sometimes it sits somewhere in between the two.

A unique vantage point. Shopper also occupies a special place within the larger enterprise, which is both a strength and a weakness. Sometimes it is housed within the brand group, which oftentimes underestimates the challenges of connecting with shoppers at retail. Sometimes it resides within sales, which frequently focuses only on the value of short-term promotions. Sometimes it sits somewhere in between the two.

It’s time to re-align. Too often, Shopper is bounced back and forth between marketing and sales, like a ping-pong ball. Where it lands largely depends on the goals and objectives of the organization itself. That it so often finds itself in limbo suggests that the goals and objectives at some organizations are less than clear. As one Confab member put it: “Shopper has been this strange little land where it is whatever the hell you say it is.”

From metrics to sabermetrics. Yet Shopper's place in between silos, as not quite brand and not quite sales, gives it a valuable understanding and appreciation of both, and the potential to bridge the gap and mediate the perpetual struggle between the two. Shopper is the “moneyball” of the brand and retail experience; that is, an undervalued asset.

Finding common ground. This understanding of what separates Shopper from the rest of the brand and retail universe matters, but it pales in comparison to what it shares. The key to the future of Shopper, and the brand/retail concept in total, is not what makes it different. Nor is it about morphing marketing into sales or shopper into sales and marketing, or tearing down silos. It’s not about re-litigating the divisions of the past or competing in the present.

A culture of specialists. It's about each specialist understanding each other’s expertise, and how everyone works together toward the shared values of the organization in total. It's about a collaborative culture, not a competition. It’s how the success of each depends on the success of the other, and we are all part of the same business strategy.

That’s not just the future of Shopper; that’s the future, period.

A chorus for change. This may appear to be an outsized conclusion to draw based on a mere five hours of conversation on a rainy Tuesday in October -- and it is. As the fourth Confab on the Future of Shopper, it built upon three previous meetings. The 11 voices in the room both echoed and amplified those of dozens of others heard during similar discussions over the preceding 18 months, as well as previous interviews and other research conducted over the past three years.

Moving at the speed of shoppers. Specifically, the cumulative effect of our day at the Yale Club was further informed by two additional Confabs on the Brand Experience, during which about a dozen chief marketing officers from a diverse set of major brands pondered the future. Layered on top of this are two research studies, one on Shopper and the other on brand, that provided additional intelligence as well as a framework in which to consider and begin to map out what it will take to get from here to there -- not consumer or shopper, not marketing or sales -- but to a “new age of commercial innovation” predicated upon the brand and retail experience as a single idea, moving at the speed of shoppers.

The four dimensions of the brand & retail experience

While much murkiness remains, order is discernible within the chaos by breaking down the challenge into four overlapping areas, or dimensions: organization; innovation; implementation; and measurement. It is all too easy to chase after any one subset of these four dimensions -- especially the bright, shiny objects of digital and big data. Some discipline is best brought to bear on the process, and establishing a framework is helpful:

While much murkiness remains, order is discernible within the chaos by breaking down the challenge into four overlapping areas, or dimensions: organization; innovation; implementation; and measurement. It is all too easy to chase after any one subset of these four dimensions -- especially the bright, shiny objects of digital and big data. Some discipline is best brought to bear on the process, and establishing a framework is helpful:

- Organization: What must be done from an organizational, structural, or operational standpoint to make the brand/retail experience an integral part of the company culture?

- Innovation: How must a brand or retailer anticipate, embrace and design a culture of innovation to optimize the brand/retail experience?

- Implementation: What are the most effective ways to bring a brand/retail strategy to life across the many consumer and shopper interactions that define the brand/retail journey?

- Measurement: How to determine that the brand/retail experience is producing sales, profits, health and growth?

Excellence in, and symbiosis between, all four dimensions — organization, innovation, implementation and measurement — is critical to harmonizing the brand and retail experience. Each dimension is embedded within and dependent upon the other. They must be viewed holistically, in osmosis. In future updates, we will examine and explore each of these four areas in detail.

Up Next:

Part Two: Culture: Ground Control to Major Tom

Part Three: Innovation: Butch Cassidy & The Brand Experience

Part Four: Execution: Real-time Retail & Stranger Things

Part Five: Measurement: The Experience is the Metric

Part Six: Conclusion: Ask Not What Your Shopper Can Do For You

ORGANIZATION

Ground control to Major Tom

The soul of the customer journey

Having a healthy organization is foundational; without a happy, communicative, and culturally aligned organization, one cannot expect to have happy, communicative and culturally aligned customers. The organization is the heart and soul of the brand and retail experience.

Having a healthy organization is foundational; without a happy, communicative, and culturally aligned organization, one cannot expect to have happy, communicative and culturally aligned customers. The organization is the heart and soul of the brand and retail experience.

It is hard, if not impossible, to see how any organization could hope to optimize the customer journey across every conceivable touch point in an organization where collaboration, teamwork and knowledge sharing are walled off. A holistic brand/retail experience mandates a holistic organization. Whether there is a cure for silos remains an open question, however.

The cultural evolution of silos. Gillian Tett, author of The Silo Effect (Simon & Schuster, 2015), argues that the issue of corporate silos is cultural, not organizational. Tett is a cultural anthropologist who spent time living with and studying villagers in Tajikistan, in Central Asia, and applies what she learned to "tribes" in corporate settings.

Her main point is that people naturally define their roles by classifying and differentiating themselves socially. This does not necessarily happen with any hostile intent, but becomes entrenched over time and helps explain the failure to understand and communicate with those outside one's group — be it marketing, sales, technology, human resources, finance, and so forth.

In other words, it may not be necessary to change the organizational structure at all. The answer may be more cultural in nature, and the imperative to find ways to enable better communication and understanding between those in the silos, and not necessarily tear down the silos themselves.

The single-word solution. Dwayne Chambers, a former chief marketing officer of Krispy Kreme (now CMO of PF Chang's), says that the doughnut retailer addressed this problem, in part, by distilling its brand's essence into a single word: Joy.

-

"We have a lot of different people whom we have to serve in 24 countries. We have a lot of languages, a lot of cultures, and a lot of things to consider. It is just so interesting how this concept of ‘joy’ cuts through all of that. There are cultures that don’t smile. There are cultures where laughing means you’re nervous. They still have joy; they just express it a different way."

Having both a purpose & a promise. Scott Moffitt, chief marketing officer of Keurig, frames cultural consistency by establishing both a purpose and a promise. The purpose is what the brand promises to do; the promise is how it does it. Drawing on his tenure as CMO at Nintendo, Moffitt says the purpose at the games-maker is simply “to put smiles on faces” while its promise is “fun.”

The power of shared values. Leontyne Green-Sykes of IKEA emphasizes the central role of the organization's culture as the driver of a consistent brand experience on a global basis:

-

"The culture is an outcome of the values we have at IKEA, and the passion that we have for creating a better everyday life for people. We take those values into our recruitment process, and the way we work with our agency partners. It is the foundation for how we behave and respond across the board. As a result, we don’t worry about compromising our culture, particularly as we expand into different states and countries."

Aligning objectives on “purpose.” The issue of silos may also be less pronounced in organizations with a strong sense of purpose, or mission, such as Seventh Generation, which is devoted to environmentally friendly household products. CEO Joey Bergstein says silos are less of an issue because the "organization is so aligned around who we are and what we're about that there's a consistency that goes through the company and the singularity of our mission. What you don't see is a lot of dueling priorities."

Silos can be a good thing. Within Seventh Generation’s apparently "horizontal" culture, individuals maintain their specialties. "Everybody's got their areas of expertise but people are working together … There is a real shared understanding of the mission and how we go about making that effective for us," says Bergstein. So, it's not that silos do not exist; it's rather that they don't get in the way of a holistic brand/retail experience. At Seventh Generation, the brand experience is "managed in parts, separately," but Joey doesn't see a conflict in that:

-

"My general belief is that people have different experiences with the brand and each one of those experiences needs to be thought about individually and managed for what it is. We need to think holistically and make sure that it all hangs together as a whole. But the truth is that every consumer has a different entry point into the brand and each one of those experiences has to be coordinated for consistency, but individually managed by the people responsible for those entry points."

Everyone owns the experience. At Arby's, where Rob Lynch is President, the experience knows no boundaries. "Organizations that allow every function to weigh in and be a part of the brand experience are going to outperform those that don't," says Lynch. "Everyone should feel like they own the brand experience."

Meanwhile, from a purely retail perspective, Paul Latham of Costco comments:

-

“We don't believe that the leadership responsibility lies even predominantly within the marketing group. We believe that the brand experience has to be embedded in the culture. It has to be lived, believed and exercised every day. Managers must have the autonomy to make decisions that they feel are in the best interests of our members. Although there are company protocols to guide them, they must have the freedom to do what they believe is right, driven by their own moral and ethical compasses."

Ground control to Major Tom. While silos may serve a useful purpose, communication between them is critical. This is challenging for any number of reasons, but is certainly compounded in the digital world and the scourge of endless emails. Some companies are dispensing with outdated technologies like email and using something like an internal social network to improve communications between all members of the organization. Eduardo Conrado, the chief strategy and innovation officer of Motorola Solutions, comments:

-

"The greatest untapped value of social networks is people. As you communicate with your customers externally, as well as with your own people internally, it allows them to express their feelings, sentiments or even ideas back to you."

Re-casting internal communications as a social network promises substantial improvements in all dimensions of the brand/retail experience, potentially enabling once-silod operatives to converse and better understand one another in real time.

Up Next:

Part Three: Innovation: Butch Cassidy & The Brand Experience

Part Four: Execution: Real-time Retail & Stranger Things

Part Five: Measurement: The Experience is the Metric

Part Six: Conclusion: Ask Not What Your Shopper Can Do For You

Past Episodes:

Part One: Shopper's Brand New Bag

INNOVATION

Butch Cassidy & the shopper experience

It's all about real life

Darren Serrao, former head of innovation at Campbell Soup, and now Chief Growth Officer of ConAgra, says that "innovation is about creating long-term, sustainable growth through differentiated solutions that bring new meaning and value to consumers." He also says this:

Darren Serrao, former head of innovation at Campbell Soup, and now Chief Growth Officer of ConAgra, says that "innovation is about creating long-term, sustainable growth through differentiated solutions that bring new meaning and value to consumers." He also says this:

-

"Thinking of the consumer experience as the outcome is an important shift in marketing innovation. We're no longer thinking about the product alone as the outcome. When we make that shift, we can understand how the consumer experience has improved, and we can extract the value of that experience as profit."

Innovation is a way of life. The linkage between innovation and the company culture is made clear by Steve Battista, a longtime brand chief at Under Armour: "Innovation is not a department; it’s a way of life. It’s not just about the next product that we commercialize; it’s about everything from how we run our cafeteria to how we tell our story."

From this perspective, innovation is the brand/retail experience itself. It is an idea that solves a problem, and makes people's lives better on a sustained, everyday basis. Its connection to profits is direct. Sometimes such changes are incremental; for example, a cap that's easier to open or a jar that's easier to pour. Other times they are transformative, as in the wave of emerging "sharing" services, like Uber and Airbnb, or electric cars, like Tesla.

Tesla vs. the dealership industrial complex. Tesla is a particularly instructive example because not only is the product itself innovative, but so is the way it is sold. It is a classic example of the convergence of brand and retail in this new era of commerce. Tesla is not only disrupting the internal combustion engine, it is also blowing up the dealership industrial complex that has long had a lock on the way vehicles are bought and sold. Yet Tesla didn't invent the electric car, and its retail model is largely lifted from Apple's.

In fact, Tesla's original retail strategist, George Blankenship, previously served in a similar role at Apple. He explains: "When I started at Apple in 2000, most people knew one thing about Apple computers: They didn't want one." Apple changed that, in no small part, by opening stores in busy places and seducing consumers with eye-popping products and a great retail experience. "Our mission," Blankenship says, "was really about getting in front of as many people as possible on a day-in, day-out basis and teaching them about Tesla."

Yet another lesson in retail innovation from Apple. This is exactly what Apple did so successfully. The store's primary purpose was not necessarily to sell anything right away, but rather to teach people about digital devices. The sales would come later — and they did — for both companies. That Tesla borrowed this idea from Apple doesn't make it any less innovative. Tesla took someone else's idea and applied it in a new way, making it its own.

Innovation cannot be divorced from the issue of organization. Can a silo'd organization, one whose denizens do not communicate, share, collaborate or understand one another, be innovative? It’s a rhetorical question. A dysfunctional, culturally misaligned organization is the opposite of innovative.

Flexing your empathy muscles. David Kelley, co-founder of design firm IDEO and the d.school for design thinking at Stanford University, believes that not only should everyone within the organization be involved in the innovation process, but also that everyone can be — and is — innovative. He told The New York Times that the idea is to build one's "empathy muscle." The goal, he said, is to create, tinker, and relentlessly test possible solutions … that people will actually use."

The gateway to breakthrough insights & innovation. With his brother Tom, David co-authored a book called Creative Confidence, in which they defined empathy as "the ability to see an experience through another person's eyes, to recognize why people do what they do." They wrote: "We've found that figuring out what other people actually need is what leads to the most significant innovations … empathy is a gateway to the better and sometimes surprising insights that can help distinguish your idea or approach." It would follow, then, that the gateway to empathy would open widest as retail and brand experiences in symbiosis.

How 'big data' can improve the customer journey. It is usually not long before any discussion of innovation arrives at the doorstep of big data, which stands ready to provide the requisite intelligence to find the gaps in the customer journey so they can be filled and the brand/retail experience improved. John L. Kennedy, a former IBM vice-president and currently the chief marketing officer of Conduent (a Xerox spin-off specializing in business process services), illuminates innovation as a data-driven concept at the nexus of brand and retail experiences:

-

“Marketers can build brand experiences that are that much more personal and don’t even feel like marketing, that feel a little bit more like a service. Marketing now is not so much in service of selling—which helps the marketer—but more in service of what the customer wants to do."

Cheesecake Factory & the big-data promise. The full expression of big data in a retail setting can manifest itself in many — and sometimes surprising — ways. Donald Evans, chief marketing officer of The Cheesecake Factory, explains how big data helps the restaurant chain keep its brand promise to its patrons:

-

"Everything at The Cheesecake Factory is made from scratch every day in each restaurant. We have more than 200 menu items that require thousands of ingredients at 180 restaurants. We can do this because of our inventory system and the way we manage data through operations.”

From Marketing to Real Life

The “lock” of innovation in the brand/retail experience is the connection between products, services and real life. This transcends not only marketing as we’ve known it (which is mainly about the communication of brand promises). It is about the delivery of those promises. It is about demonstrating relevance, in the moment -- not just in real time, but in a way that connects emotionally and makes the shopper’s day, if not life, a little bit better. It’s hard to imagine a forward-thinking CEO or CMO or brand manager who wouldn’t care deeply about achieving this.

The “lock” of innovation in the brand/retail experience is the connection between products, services and real life. This transcends not only marketing as we’ve known it (which is mainly about the communication of brand promises). It is about the delivery of those promises. It is about demonstrating relevance, in the moment -- not just in real time, but in a way that connects emotionally and makes the shopper’s day, if not life, a little bit better. It’s hard to imagine a forward-thinking CEO or CMO or brand manager who wouldn’t care deeply about achieving this.

The “key” to innovation in this realm is behavioral economics, which is the science of understanding why people make the decisions they do under a variety of circumstances. Behavioral economics stands in stark contrast to traditional economics, which assumes that people make decisions like economists -- that is, on a rational basis, by carefully calculating the cost vs. benefit of alternative choices and then selecting whatever is in their own best self-interest.

Decades of groundbreaking research led by economists Daniel Kahneman and the late Amos Tversky point in a very different direction. The evidence is that nearly all of our decisions are based on taking mental shortcuts, or heuristics, that make otherwise complex decisions seem simple. These shortcuts are not rooted in rational calculations (which are hard work) but rather emotional triggers (which come easily). It all happens so quickly that we humans don’t even realize how irrational our choices are.

Behavioral economics brings a much-needed dose of reality to understanding consumers as shoppers, and shoppers as people. Shopper -- as a business discipline -- does exactly the same thing, as it is attuned both to how people make decisions, and more important, why they make those decisions. Despite its reputation for appealing to rational calculation (i.e., price discounts), Shopper in fact is the business of understanding why people do what they do while they are shopping -- which today can happen anytime, anywhere, for any number of reasons. A brand cannot be built, sustained or grown without such understanding.

As Paul Newman once said: "You can get straight A's in marketing and still flunk ordinary life."

So, the first, and most important thing to understand about innovation in the brand/retail experience is that it is fundamentally about one thing: Real Life. In this respect it is unlike any other form of “marketing,” and in fact transcends marketing as we’ve known it to align with how people live their lives. It supports their wants and needs in real life, in each moment.

Up Next:

Part Four: Execution: Real-time Retail & Stranger Things

Part Five: Measurement: The Experience is the Metric

Part Six: Conclusion: Ask Not What Your Shopper Can Do For You

Past Episodes:

Part One: Shopper's Brand New Bag

Part Two: Culture: Ground Control to Major Tom

EXECUTION

Real-time retail & stranger things

The "demogorgon" of the shopper journey

The brand/retail experience is all in the delivery, which of course is all in the execution. This is more complicated than ever in today's "omnichannel" world. This is not a relatively simple matter of just delivering brand messages, be they ads or promotions, at every touch point.

The brand/retail experience is all in the delivery, which of course is all in the execution. This is more complicated than ever in today's "omnichannel" world. This is not a relatively simple matter of just delivering brand messages, be they ads or promotions, at every touch point.

Ominchannel is not the same thing as omnimedia. The word "channel" not only connotes media channels; more important, it encompasses transactional channels — that is, retail in all its multi-tentacled iterations.

Digital media are inherently transactional. They are invariably about the exchange of something, be that entertainment, information, conversation, goods or services. In the early days of the web, many saw cyberspace as the second coming of television, and a new way to convey advertising. It can be that, for sure. But as we all now know, it is so much more than that. It is now so deeply and prominently embedded in our world, and daily lives.

As a run-up to our Confabs, we reached out by email to chief marketing officers and others responsible for the brand/retail experience in their organizations and asked: What are your top priorities relative to the brand/retail experience? We received 28 responses, representing a cross-section of categories including hospitality, retail, food service, packaged goods, automotive, technology, financial services, media, e-commerce, beverage alcohol, musical instruments, and apparel.

Give the people what they want, when they want it. The most frequent response involved some variation on the imperative to "give people what they want, when, where and how they want it." Several respondents expressed the concept as "real-time retail," delivered via a deft combination of digital and in-store experiences. Such alignment clearly is a prerequisite of every brand in today's "omnichannel" world.

A marketing chief at a major retailer expressed this as "leaning into the opportunities in the intersection of physical and digital retail." Another respondent, the CMO of a luxury brand, took the idea a step further, stating an objective to "bring our brand story to life in a relevant way across each touch point (from awareness building, to digital, to in-store, to after the sale)," adding: "The biggest priorities are to (completely!) “reinvent both digital and retail at the same time, and design them to be absolutely synergistic. When implemented, the customer will flow from digital to retail to digital in an absolutely seamless manner.”

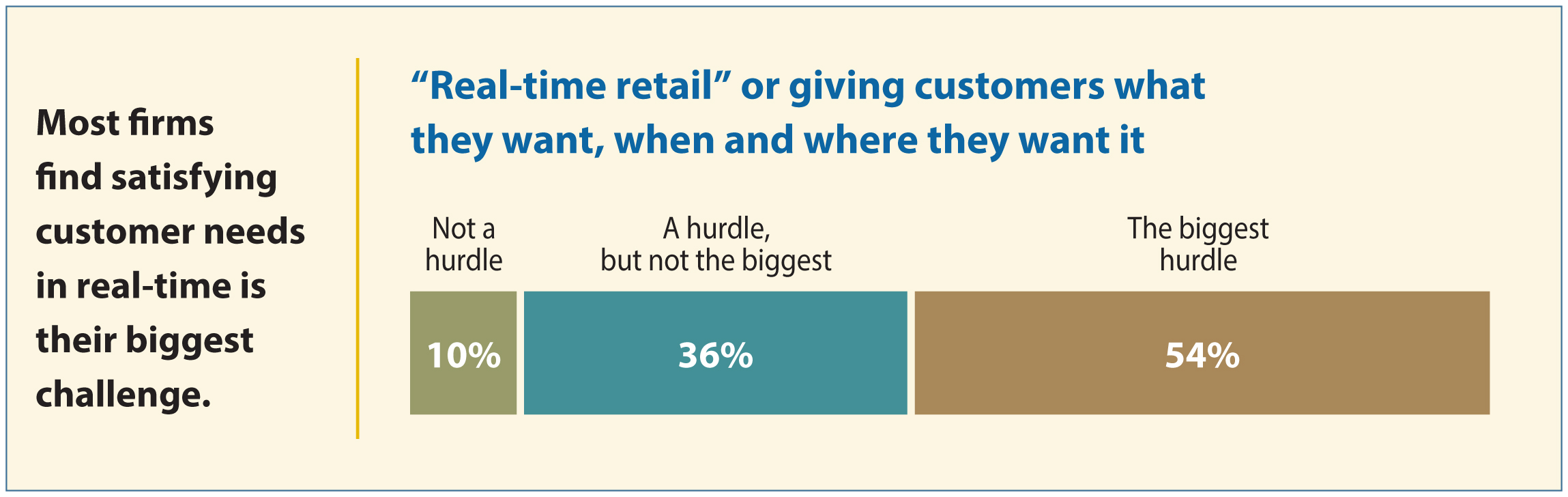

Implementation is the "demogorgon" of the brand/retail experience. In a follow-up survey, with 72 CMOs and other brand and retail leaders across a wide spectrum of product and service categories, 34% said that "implementation" was the greatest threat to the brand and retail experience. Fifty-four percent said that "real-time-retail" was their greatest brand-experience hurdle.

Why is "real-time retail" so difficult to implement?

The packaged-goods conundrum. Douwe Bergsma, chief marketing officer of Georgia-Pacific, frames the challenge from a consumer packaged-goods perspective:

-

"First, we do not have seamless integration with the in-store environment. The digital experience is not in line with our packaging, or the look and feel of our products when you see them in the store. You could also have the most wonderful digital experience with the consumer and then get placed at the bottom shelf in the store where the consumer does not expect to find your brand."

Kawasaki & the voice of the brand at retail. Chris Brull, head of marketing for Kawasaki, says apps offer a solution at retail because his brands are sold through dealerships that also sell competitive products. What's more, because Kawasaki doesn't own its own stores, sales associates are challenged to know all of the many details of Kawasaki's line of motorcycles and other recreational vehicles. "When a customer walks into a store, the product has to speak to the customer," says Brull. The app provides the requisite "voice."

The point-of-purchase as point-of-pain. A silver-bullet solution for every type of brand is unrealistic, however, given the varied objectives of different product and service categories. In the retail apparel category, former Old Navy CMO Ivan Wicksteed cites a variety of issues, but anchors his focus in "the points-of-pain for the customer."

The point-of-purchase as point-of-pain. A silver-bullet solution for every type of brand is unrealistic, however, given the varied objectives of different product and service categories. In the retail apparel category, former Old Navy CMO Ivan Wicksteed cites a variety of issues, but anchors his focus in "the points-of-pain for the customer."

Going digital is not the point. In store, the customer challenges center on finding the right size or color, the discomfort of the changing-room experience, and perhaps most of all, the nuisance of check-out. "The experience is not about making it as digital as possible," Wicksteed says, while noting that digital can be applied to good effect when it comes to delivering the goods. "Not everyone wants to walk out of the store with the product," he says. "If I can get your purchase back to your hotel room faster than you can get back to your hotel room — which is possible today — then that becomes a compelling proposition."

The limited value of apps. On the other hand, Wicksteed sees limited value in apps, at least in the apparel category. "An app can help you find what you're looking for, or serve up specific offers. Price checking is another thing people do on their phones in-store. This makes less sense for Old Navy; you can't price-check our goods since we're the only retailer that sells what we sell."

Uberfication & the untapped potential of back-room technology. As Wicksteed sees it, the best use of digital in-store is "not the sexiest technology" but rather the "back-room technology that tells us where all the physical inventory is, down to an individual product level at any point … If you add that together with the Uber-fication of the world, it means that you're radically transforming your ability to get goods to people either from a distribution center to a store, or from one store to another store or from a store to a customer."

Fender & the local dimension of real-time retail. Richard McDonald, EVP of Fender Musical Instruments, looks at the relationship between online and in-store operations through a somewhat different lens, but one that is no less focused on "real-time retail":

-

"What's interesting about the digital age is that even if you purchased an instrument online you still engage at a local level. That's why local stores and partnerships are so important to us. Once you get the guitar, you might need someone to help you learn how to play it. You might need repairs. You might want to meet other guitar players. You're going to want to interact and have your interests fueled. That's the purpose of these local-market retailers. They are a very, very important part of the overall ecosystem."

Hointer: a blinding flash of the future. Real-time retail is being brought to futuristic fruition by Nadia Shouraboura, a former head of fulfillment for Amazon and now founder of Hointer, which The Wall Street Journal called "a shop that possibly represents the most radical synthesis of offline and online retail yet."

Hointer: a blinding flash of the future. Real-time retail is being brought to futuristic fruition by Nadia Shouraboura, a former head of fulfillment for Amazon and now founder of Hointer, which The Wall Street Journal called "a shop that possibly represents the most radical synthesis of offline and online retail yet."

At Hointer, shoppers encounter no sales people, just rows of designer jeans, suspended from the ceiling by wires, each tagged with a QR code. Shoppers scan codes of the jeans they like, select the size, and the Hointer app keeps track. Each pair is summarily delivered via a chute to a dressing room. If the jeans aren't right, shoppers can toss them down another chute, and the pair vanishes from their list.

To buy chosen pairs, shoppers use a touch-screen terminal where they tap a button corresponding to their dressing room and swipe a credit card. On a second trip, with credit card on file, shoppers can skip checkout altogether. At first blush, Hointer sounds like a really cool app, but in fact the real story is what's going on in the back room.

The rise of the microwarehouse. The technology required to deliver those jeans in about a half a minute is all about logistics and distribution. Shouraboura’s innovation is a "microwarehouse" that networks individual stores into a distribution hub and makes the dream of same-day delivery a reality. In other words, the future of the shopping experience is decentralized and agile distribution. Shouraboura is now applying this concept in grocery.

Up Next:

Part Five: Measurement: The Experience is the Metric

Part Six: Conclusion: Ask Not What Your Shopper Can Do For You

Past Episodes:

Part One: Shopper's Brand New Bag

Part Two: Culture: Ground Control to Major Tom

Part Three: Innovation: Butch Cassidy & The Brand Experience

MEASUREMENT

The experience is the metric

How to measure the moments that matter?

Ultimately, success in the brand/retail experience must be measured, but what are the metrics? Unlike the past, in the traditional world of brand and marketing alone, measurement is not limited to the media/communications aspects of making brand/retail promises.

Ultimately, success in the brand/retail experience must be measured, but what are the metrics? Unlike the past, in the traditional world of brand and marketing alone, measurement is not limited to the media/communications aspects of making brand/retail promises.

Now that the remit has expanded across each and every possible interaction, the measurement mandate is considerably more complex. It stretches across the entire customer journey.

The “how” and “what” of measurement. No shortage exists with respect to means of measurement. The issue is not as much how to measure but determining what to measure. The question inevitably reverts back to the lack of alignment of goals and objectives across the organization. What Sales, Marketing and Shopper might consider a good result can -- and apparently usually is -- viewed quite differently.

Quantifying each and every interaction. These discrepancies must somehow be reconciled into a holistic view of success that accounts for the brand/retail experience in total. It’s not enough just to capture media impressions or document sales lifts. The challenge is to somehow quantify how each and every interaction either contributes to or subtracts from the brand/retail experience. Measurement must factor in the three other dimensions of the overall enterprise: organization, innovation and implementation.

-

Organization: a shared interest in emotional engagement. The imperative is to acknowledge weakness and double down on the strengths of both Marketing and Shopper. Let’s admit it: too little of Marketing is relevant to people when they are deciding what to buy, and too much of Shopper corrodes brand image and identity. Marketing’s strength is its ability to communicate messages and raise awareness; Shopper’s strength is its ability to convert all of that great brand work into cold, hard cash.

Marketing and shopper share a very important common goal: to engage and inspire the customer on an emotional level, but in different ways. With Marketing, it’s aligning with how consumers think about the brand; with Shopper it’s aligning with how consumers behave when they’re deciding which brands to buy. Both are equally invested in achieving the emotional engagement that is essential to brand health and growth. They simply do so in different ways, at different moments along the customer journey. Every moment matters.

Innovation: the convergence of products and services. In marketing, innovation is traditionally thought of in terms of products but the context in which those products are experienced is equally important. As Tesla, Apple and others have demonstrated, products and services (i.e., brands and retail) are now one.

Over the long-term, it’s important to keep in mind at least one thing Marketing and Shopper share: An interest in helping people become better versions of themselves. Michael Schrage details this concept in his book, Who Do You Want Your Customers To Become?

Schrage’s theory is that it’s no longer sufficient simply to fulfill or satisfy a customer’s expectations, or even exceed them in the usual sense. Truly forward-thinking enterprises are leading their customers, and teaching them how to expand their personal potential. Examples include not only the usual suspects like Amazon, Apple, Facebook and Google, but also IKEA, Southwest Airlines, Microsoft, Khan Academy and, yes, McDonalds.

It’s little remembered now, but the idea of ordering food at a window and consuming it in your car represented a radical departure in consumer behavior in 1955. McDonald’s taught its customers a new way to eat, designed for the age of the automobile.

Implementation: making moments that matter. Our research has shown that chief marketing officers believe they have no shortage of great ideas; it’s making the ideas work, at each and every interaction along the customer journey, that’s the challenge. As noted above, the brand/retail experience is tantamount to the customer’s journey and every opportunity to engage and build or erode the bonds of loyalty.

Acknowledging that Marketing and Shopper are fellow travelers along the same customer journey would be a sensible place to start. Agreement that each complements the other along that journey really shouldn’t be a matter of contention. Both have roles to play with respect to touch-points both digital and analog, but again, in different ways.

Recognizing each other’s respective talents is certainly a key imperative. That Marketing does a great job of building brand image and identity is beyond question. That Shopper knows how to translate those equities in the noisy, chaotic and crowded retail environment should be equally respected. Granted, the creative expression of that expertise could be improved in many cases, but perhaps that’s a fresh opportunity for Brand and Shopper to collaborate, combining the former’s aesthetic sensibilities with the latter’s insight into why shoppers behave the way they do.

Storytelling is perhaps the most fundamental tie that binds the brand/retail experience, and Marketing with Shopper. The journey is a story that can and should be told differently, depending on who, what, when, where -- and especially the why -- of the stop along the way.

A new template for measuring health & growth

How to quantify the moments that matter? What are the implications of all of the above on the issue of measurement? It appears that measurement should be looked at differently, not only as the quantification of media impressions or sales lifts, but also in terms of engagement, both internally and externally.

How to quantify the moments that matter? What are the implications of all of the above on the issue of measurement? It appears that measurement should be looked at differently, not only as the quantification of media impressions or sales lifts, but also in terms of engagement, both internally and externally.

Quantifying the conversation. Perhaps the most significant data point is a measure of how well people within each organizational silo are communicating with and understanding those in the other silos. At the very least, this could be a leading indicator of the organization’ health, and therefore its growth.

Mapping out measurement. Might the customer journey map itself provide a template upon which to track health and growth? Some quantification of the “moments that matter” along the way could be the most holistic, and therefore accurate, gauge of success.

The tipping point between heart & wallet. Success is often a function of the extent to which the customer is engaged, inspired or otherwise motivated on an emotional level along the journey. The balance between heart and wallet can be treacherous, however. The limitations of available metrics are telegraphed by Jeff Charney, chief marketing officer of Progressive Insurance, who succinctly observes: "Technologies cannot quantify feelings.”

Arby’s: We have the metrics! Arby's president, Rob Lynch, aspires to rise to this challenge. "We need to explicitly show how we connect our insights to our sales and profits, or some other performance result," he says. "When we invest in driving an intangible like 'friendliness,' we need to know that an uptick in that metric is the equivalent of a sales increase. Building that linkage is a big opportunity across the industry." He adds: "It's one thing to have the measurements. It's another to believe in them, trust them and then make investments based on them."

Up Next:

Part Six: Conclusion: Ask Not What Your Shopper Can Do For You

Past Episodes:

Part One: Shopper's Brand New Bag

Part Two: Culture: Ground Control to Major Tom

Part Three: Innovation: Butch Cassidy & The Brand Experience

Part Four: Execution: Real-time Retail & Stranger Things

THE FUTURE

Ask not what your shoppers ...

The future of brands & retail is not rocket science

Legend has it that on a tour of NASA in 1962, President Kennedy approached a man pushing a broom. "Hi, I'm Jack Kennedy," the President said. "What are you doing?" The man replied: "Well, Mr. President, I'm helping to put a man on the moon."

Legend has it that on a tour of NASA in 1962, President Kennedy approached a man pushing a broom. "Hi, I'm Jack Kennedy," the President said. "What are you doing?" The man replied: "Well, Mr. President, I'm helping to put a man on the moon."

Like so many other legendary stories, this one may be apocryphal. Would JFK have asked a man pushing a broom what he was doing? Maybe he did, but the point is clear: This man may not have been a rocket scientist, but was part of the journey nonetheless.

A man pushing a broom is not intended as a metaphor for Shopper’s role within the broad context of the brand and retail culture. It is rather a vivid illustration of the universal truth that success ultimately depends upon a living, breathing network of many different types of people with many different kinds of skills. Everything, and everyone, matters. Every moment matters.

This truth certainly applies as much to an organization like NASA, where teamwork means the difference between life and death, as it does to brand and retail organizations, where the stakes are limited to health and growth.

The brand and retail experience, in this “new age of commerce” is inherently horizontal and holistic. If the brand/retail experience is confined to one department or another it cannot possibly be optimized. The brand as retail and the retail as brand, the shopper as consumer and the consumer as shopper, must resonate in every part of the organization and rally each and every soul within it.

The Future from a Shopper Perspective

No discussion of the future would be complete without some consideration of the implications of the Amazon-Whole Foods merger. Much has been written in speculation over where this ostensibly unlikely marriage is headed, as well as the effect it will have on retailers and brands alike.

Rob Duboff of HawkPartners suggests that Amazon bought Whole Foods because while Amazon knows how to sell digitally, it doesn’t understand the retail environment and bought Whole Foods to figure it out. He comments: “I think Amazon’s getting in there to say, why aren’t we using these spaces more creatively?”

From whole paycheck to bargain basement. For retailers, it appears that Amazon is hitting the fast-forward button on real-time retail while also taking dead aim at grocery prices. Famously willing to forgo margins in pursuit of its larger goals, few if any other grocery retailers have that luxury. Supermarkets struggle under notoriously slim profits (in fact, most grocers make more money buying goods from brand owners than selling them to shoppers, but that is a subject for another day). Some irony lurks within as well, given Whole Foods’ “whole paycheck” reputation.

For brands, the picture is no less daunting. The Amazon-Whole Foods juggernaut portends a world in which consumers maintain online standing orders for the products they use routinely and go to the store only for on-the-fly needs or to experience the bounty of fresh goods and its attendant sensory experiences. Instead of viewing supermarkets as the dreary place where they waste their time looking for whatever it is they are looking for from among some 30,000 items, they may actually begin to see grocery shopping as fun, not unlike other kinds of recreational, or even luxury, shopping.

A dramatically changed theater of commerce. If such notions take root at Amazon/Whole Foods and then spread to other retailers, it could mean that only a handful of brands in any given category will be available at the store, and even those will play second fiddle to a dramatically re-imagined grocery shopping experience. Presumably, the retailers’ own brands will be in the spotlight, with all others reduced to supporting roles.

Sounds scary, right? Yes it does. However, the potential upside, as one Confab member remarked, is that “Amazon and Whole Foods have scared retailers to such an extent that it does open up an opportunity to have a very different discussion.”

Catching the wave of the future

We also asked our current crop of Confab members for their parting thoughts on the future:

-

Power to the people: “The power has shifted. Retailers and brands used to dictate commerce and how it all operated. Now that power has shifted to consumers. Retailers and brands are going to have to evolve to what the consumer wants. Brands and retailers, now and in the future are going to have to work together to meet consumers’ demands because the consumer wants very specific experiences. Otherwise, they’ll just go somewhere else, and someone else will provide it to them.”

-

Excite your consumers: “Digital and technology have changed the consumer. They’re bored with the choices out there. Their attention span has gone down from 12 seconds to 7 seconds. Then you look at the store and it’s crowded with all the messaging and everything else. It’s just becoming increasingly important to disrupt and insert your brand in their lifestyle. If we don’t do that now, it’s going to become harder and harder as e-commerce takes traction.”

-

Change the conversation: “I’m looking forward to not talking about top-down versus bottom-up, consumer versus shopper. Right now, that is the reality of the present. We keep having the same conversations, and the fact that in this day and age that we’re still trying to define Shopper, and how to measure it -- it’s just weird that we’re still having this conversation. Some of these meetings you could just record and play every five years.”

-

Embrace the complexity: “We need to be great at a few things versus all the things that we could or should be doing and focus on clear direction and priorities. We make our choices based on retailers, and have this very long tail of choice. We need to embrace the complexity of different consumer needs at different times rather than just solve for it. Siloes are going to break down and that’s great, but now you’re matrixed and it’s not clear who is responsible for what. How do you move faster?”

-

The consumer is the shopper: “If you don’t truly understand your consumer if you don’t understand how your consumer behaves as a shopper. I think that leads into so many different areas of potential change, implications that depending where the brand is on the journey, or organization on their journey, they could be so silo'd that the question of how your consumer is behaving as a shopper could get you to a better place.”

-

The answer is ringing in your pocket: “The phone has changed people’s behavior. The activities we need do to reach people at different times as they’re going down the path is critical. It’s not all one big shopping trip; it’s often ten minutes at a time. So, all of the ideas that we talked about really need to come together and we need to continue to push out to the organizations so they know the impact we’re having on the business as a whole.

-

It’s all about insight: “It’s about understanding the pulse of the industry. Test and learn as much as possible. It’s about making sure everything is based in insight, by listening to shoppers in a layered approach. All holding hands together as we look to influence our organizations and what we think is best for our collective growth. It’s just very fascinating, all of it.”

203-227-6004

Part One: Shopper's Brand New Bag

Part Two: Culture: Ground Control to Major Tom

Part Three: Innovation: Butch Cassidy & The Brand Experience

Part Four: Execution: Real-time Retail & Stranger Things

Part Five: The Experience is the Metric

Part Six: Conclusion: Ask Not What Your Shopper Can Do For You

Existential Topics for Future Discussion

1. Commercial Sabermetrics: Separating behavioral insight from the chaos of big data.

2. Cultural Barbarians : Understanding the world outside one’s silos.

3. Real-Life Retail : Getting straight A’s in everyday life.

4. The McLuhan Effect : When the experience is the brand.

5. Relevance : Making moments that matter.

6. Digital Nativism : Navigating the vagaries of real-time retail.

7. Community Service : Keeping your peeps engaged.

8. Playing Buckyball : The care and feeding of brand & retail stories.

9. Measure Twice : Measuring success beyond media, message or sales.

10. The Scarcity Principle : Luxury is a rarity, not just a price point.

11. 5D Chess : Connecting emotionally & culturally using all five senses.

About This Report

Shopper’s Brand New Bag is based on a combination of one-one telephone interviews, face-to-face discussions and online surveys involving the following companies:

Shopper: 3M, Barilla America, Bayer HealthCare, BIC, Beiersdorf, Boehringer Ingelheim, Bush Brothers, Church & Dwight, Coca-Cola, Colgate-Palmolive, ConAgra, Del Monte, Edgewell, Elizabeth Arden, FedEx, Gallo, General Mills, GSK, Hasbro, Hill’s Pet, Hormel, Imperial Brands, Johnson & Johnson, Kellogg’s, Kimberly-Clark, Mead Johnson, Mars Chocolate, Mondelez, Nestle, Pinnacle, Procter & Gamble, Sony, Starbucks, Time Inc., Unilever, and Walmart.

Brand & Retail: 1 800 Contacts, American Airlines, Arby’s, Auntie Annies, Bacardi, Brown Forman, Build A Bear, Butterball, Campbell Soup Company, Capital One, Caribou Coffee, Carmax, Carnival Cruise Lines, Cheesecake Factory, Cohen Fashion Optical, ConAgra Foods, Costco Wholesale, Darden, Dennys, Discovery Education, Dreamworks, Dunkin Brands, E&J Gallo Winery, Fender Musical Instruments, Fidelity Investments, Fiskars, Forever 21, General Electric, Georgia-Pacific, Gortons, Hallmark, Hasbro, Hershey, Home Shopping Network, IKEA, International Speedway Corporation, Jack in the Box, JetBlue, Kate Spade, Kawasaki Motors Corp., Kiehl’s, Kimberly Clark, Lenovo, Lenscrafters, Mary Kay Inc., Mazda, Meijer, MillerCoors, NASCAR, NBC Sports Group, Nintendo, Panera Bread, Peapod, PNC, Quiznos, Safeway, SAP, Serta International, Seventh Generation, Southwest Airlines, Sperry Top-Sider, Stanley Black & Decker, Starbucks, Starwood Hotels, Steinway & Sons, Stew Leonard’s, The Cheesecake Factory, The Limited, The Wendy's Company, True Value, Ulta, Under Armour, United Way, US Olympic Committee, Virgin Atlantic, Vistaprint, Walgreens, Walmart, and Wawa.

Acknowledgements

Thank you to our esteemed and distinguished Confab members for another spirited discussion that added our “living” repository of ideas and contributed to the growing body of intelligence and insights into the future.

Debbie Zefting of Barilla America; Pat FitzSimons of BIC; Barry Roberts of Colgate-Palmolive (emeritus); Beth Orozco of E&J Gallo; Cara Kahaly of GSK; Mike Clifford of Kellogg’s; and Eric Szegda of Time, Inc.

Thanks to Michael Dill and Brian Kittelson of Match MG, for helping to make the day possible.

Special thanks to our moderator, Rob Duboff of HawkPartners, and to Jeff McElnea of The Jeffrey Group, our Yale Club host. Thanks to Chris Hoyt, Nancy Swift and Dan Flint of Lucidity LLC, Peter F. Eder of Peter F. Eder & Associates, and Al Wittemen of St. John's Partners for their insights, intelligence and guidance.

In addition, we would like to acknowledge the ongoing support and insights contributed by Matt Perry of Walmart, John Mount of Coca-Cola, Tiffany Huey of Starbucks, Deanna Maestas of Johnson & Johnson and Andrew Kingery, formerly of Beiersdorf.

Suggestions for further reading:

-

Thinking Fast & Slow (Daniel Kahneman)

Misbehaving (Richard Thaler)

Predictably Irrational (Dan Ariely)

The Silo Effect (Gillian Tett)

The Content Trap (Bharat Anand)

Who Do You Want Your Customer to Become? (Michael Schrage)

Creative Confidence (David Kelley and Tom Kelley)

The Power of Habit (Charles Duhigg)

Competing Against Luck (Clayton Christensen)

Shopper Marketing (Chris Hoyt, Nancy Swift, Dan Flint)