The state of Shopper in 2018 is good. This sweeping assessment is crystallized in the response to a single survey question, in which our respondents were asked to “rate the overall shopping experience provided by your brand.” The average response was 3.2 stars out of 5. Three stars is “good.” It’s fair to ask, though, what will it take to move Shopper from “good” to “great”?

The state of Shopper in 2018 is good. This sweeping assessment is crystallized in the response to a single survey question, in which our respondents were asked to “rate the overall shopping experience provided by your brand.” The average response was 3.2 stars out of 5. Three stars is “good.” It’s fair to ask, though, what will it take to move Shopper from “good” to “great”?

Many of the issues standing in the way are familiar: A lack of training, funding, and measurement. These challenges have shown up in a big way in our surveys for at least the last four years, and certainly to some degree since Shopper burst on the scene a dozen or more years ago. Shaky communications with the brand team, and conflicting goals and timelines between Sales, Marketing and Shopper, also stubbornly pock the landscape. These apparently intractable issues, and more, play out in a variety of ways in the responses to our latest survey’s questions.

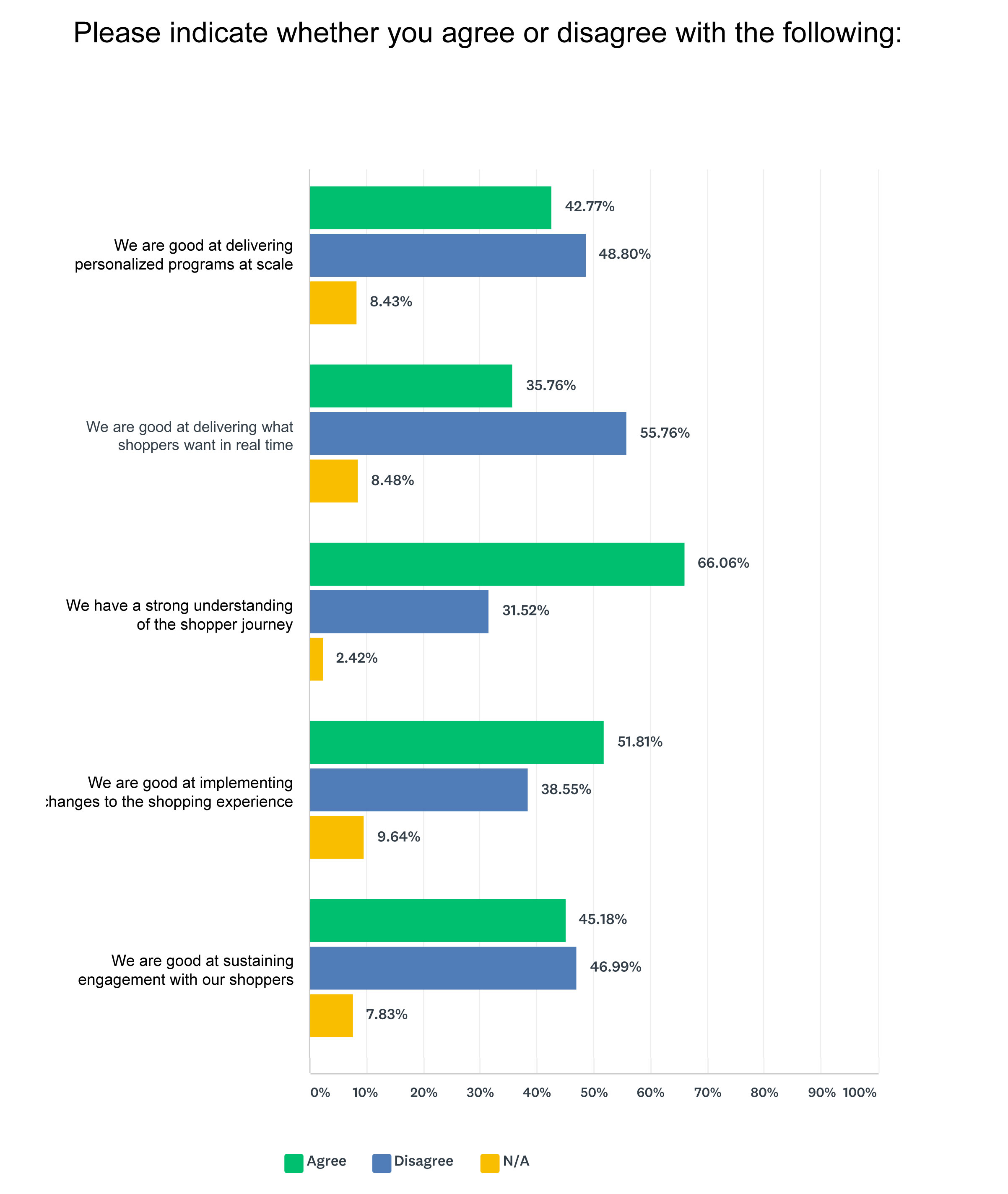

Shopper’s efforts to personalize at scale seem to be falling a bit short, for example, as is its capacity to respond to shopper needs in real-time. Only by the narrowest of margins did respondents claim success at sustaining engagement with shoppers. Arguably, these should be core Shopper competencies and point to key areas in need of attention.

Yet a certain level of confidence is evident. Most say they have a good understanding of the shopper journey and are good at making changes to the shopping experience. While a razor-thin plurality of 42.73% rate Shopper success as “good,” a nearly equal percentage of 42.29% say it is either “very good” (33.04%) or “excellent” (9.25%). A number of respondents cite the rise of digital commerce as an opportunity for Shopper. About half say Shopper leads in digital innovation. Some perceive digital as a potential threat to Shopper, at least in terms of budgets, however.

Lurking in the background, meanwhile, is the possibility that digital’s rise could help trigger a renaissance in old-fashioned, in-store shopping experiences, and with it more opportunities for Shopper to show its full potential as a strategic platform for commercial innovation in stores. Sixty-seven percent see Shopper as a platform for innovation, and 30% view “innovation” as their brand’s greatest strength relative to Shopper, second only to “implementation,” at 36%.

The overarching imperative is for Shopper to cross the great divide from garden-variety tactics to blue-sky innovation. This transition can happen in a variety of ways.

From marketing to real life. Where Advertising is the business of communicating promises, Shopper is the business of delivering on those promises. It is where lifestyle aspirations meet the realities of in-the-moment choices, the unique nexus of where brand stories are told and the cash register rings.

From functional to purposeful. Every brand and retailer has one paramount purpose: their consumers. Shopper delivers on that promise by knowing their consumers well enough to know what to deliver based on when, where and why they shopping.

From discounts to solutions. Discounts are a dime a dozen, but solutions require a fundamental understanding of what it is our shoppers would like to accomplish at any — and every — given moment.

From categories to curated. Retailers have premised their business models on category management. Maybe retailers — and their packaged-goods partners — should rethink their mutual paradigm in terms of category curation. Perhaps, for example, what people would like is not necessarily a prepared meal, but a retail experience that is organized based on preparing meals.

From ‘on-again, off-again’ to ‘always on’. Historically, the individual initiatives that roll up into a long-term Shopper strategy have been discrete pockets of activity, with defined start and stop dates. The future might be a continuous platform that engages and activates shoppers, and provides solutions to their problems on some basic level, 52 weeks a year. “We need to be there when they’re ready to shop, not just around one big promotion,” says Debbie Zefting of Barilla.

From quick trips to slow shopping. It’s pretty much an article of faith that the longer shoppers shop, the more money they spend. Especially in world where the big, stock-up trip is being replaced by smaller, serial, quick trips, retailers and their packaged-goods partners should seize the opportunity to slow the pace, and find ways to keep and hold shoppers in their stores.

From one-dimensional to five-dimensional. Shopper can take full advantage of the opportunity to immerse shoppers in an experience that touches all the senses: not just sight and sound but also smell, touch and taste. A dedicated effort to create a more sensory experience promises to yield greater engagement, and with it shopper loyalty and profits for both retailers and their brand-owner partners.

From limited-time offer to lifetime value. While short-term measures are important, Shopper’s true contribution is to the lifetime value of the relationships it builds by anticipating and solving shopper problems, aligning with their aspirations, and making people’s daily lives better and happier in ways big and small.

Special thanks to Mike Clifford of Kellogg’s; Brian Sullivano of Georgia-Pacific; Matt Parry of Walmart; Debbie Zefting of Barilla USA; Alysia Ross of Danonewave, Dina Keenan of New Seasons Market, Barry Roberts and Tammy Brumfield for their keen insights into the future of Shopper. Thanks also to Nancy Swift, Chris Hoyt and Al Wittemen for their guidance and support.

PREVIOUSLY

Can someone please define shopper marketing?

Who cares how shopper is organized?

Are retailer-led programs a problem?

Is there any such thing as a shopper insight?

Where are shopper agencies falling short?

Is there a cure for marketing mix modeling?

Should ‘shopper marketing’ be re-named?