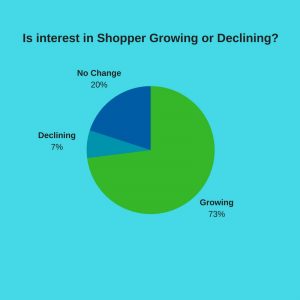

Seventy-three percent say that interest in Shopper is growing. Fifty-percent see Shopper budgets increasing, while 40% see them remaining the same and 10% foresee a decrease. Nearly one-third say they have no established budget for Shopper.

Seventy-three percent say that interest in Shopper is growing. Fifty-percent see Shopper budgets increasing, while 40% see them remaining the same and 10% foresee a decrease. Nearly one-third say they have no established budget for Shopper.

How do Shopper trends compare to two years ago?

Overall, Shopper trend lines have remained steady since our previous survey, in 2014. However, several shifts are worth noting, in particular that “internal communications” is now seen as the top impediment to Shopper success (57%). Previously, “conflicting sales, marketing and retailer objectives” was viewed as the number-one problem (64%).

In addition, the trend toward Shopper reporting to Marketing is on the rise (48% versus 33% two years ago), and positioning of Shopper as a “cross functional discipline, in collaboration with Marketing has jumped from 49% to 58%. The ability to measure results with specific retailers has increased, from 41% to 56%.

Success rates have declined, with respondents claiming “very good” (32%) or “excellent” (4%) results, compared to 40% and 5%, respectively, in 2014. There was a slight uptick in those reporting “average” results (48%) versus two years ago (44%).

Interest in Shopper has declined slightly but remains high (78% v. 73%), Meanwhile, 47% predict budget increases for Shopper, compared to 63% two years ago.