Fifty-two percent of US Shopper organizations report to Marketing, versus 43% outside the US. Significantly more report to General Management outside the US (27%) compared to the US (8%). In the US, 70% position Shopper as “cross functional strategy that collaborates with Marketing,” relative to 50% outside the US. Thirty-percent position Shopper as a function of “category management or sales,” versus 50% outside the US.

Fifty-two percent of US Shopper organizations report to Marketing, versus 43% outside the US. Significantly more report to General Management outside the US (27%) compared to the US (8%). In the US, 70% position Shopper as “cross functional strategy that collaborates with Marketing,” relative to 50% outside the US. Thirty-percent position Shopper as a function of “category management or sales,” versus 50% outside the US.

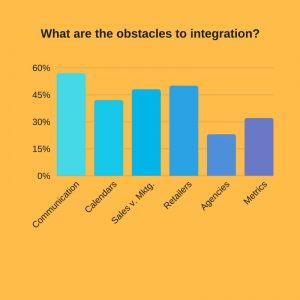

A lack of communication between departments is viewed as the number-one impediment to Shopper success both inside and outside the United States. Interest in Shopper is seen as growing inside (70%) and outside (76%) the US.

Shopper is more likely to have a dedicated research budget inside the US (58%) than outside (43%). Overall, Shopper budgets are seen as more likely to grow outside the US (57%) than inside (46%).

The scope of Shopper initiatives encompasses the entire path to purchase in the US (84%), compared to outside (54%). Use of digital media in Shopper is more advanced in the US, where 68% of those outside say digital represents less than 25% of pre-store Shopper efforts, compared to 38% in the US.

Fifty percent of US respondents say digital is involved in between 26% and 75% of pre-store initiatives, compared to just 11% of those outside the US. Shopper Marketing is far more likely to control digital media in the US (62%), whereas Marketing dominates it outside the US (69%).

Those inside the US are more likely to have a system to measure Shopper results with specific retailers (65%) than those outside (49%). US Shopper rates its success with Shopper more highly, with 45% evaluating it as “very good” or “excellent,” compared to 27% outside the US.