Overall, our survey respondents are positive about the success of their Shopper initiatives, with 48% rating results as “good,” 32% “very good” and 4% “excellent.” Fifteen percent evaluate results as “not so good” and two percent “poor.”

Overall, our survey respondents are positive about the success of their Shopper initiatives, with 48% rating results as “good,” 32% “very good” and 4% “excellent.” Fifteen percent evaluate results as “not so good” and two percent “poor.”

The top three benefits of Shopper are: “improved collaboration with key retailers – much better than in the past” (60%); “better understanding of our consumers as shoppers” (56%) and “improved cross-functional integration and cooperation between Marketing, Shopper Marketing and Sales” (50%).

Other benefits are: “a practical and efficient framework for influencing our target consumers that we did not have before” (35%); “improved penetration of key retailers at the above-buyer level” (27%); “reliably higher sales and ROI for both brands and the retailer’s category” (25%); and “improved collaboration and integration between and among agencies” (22%).

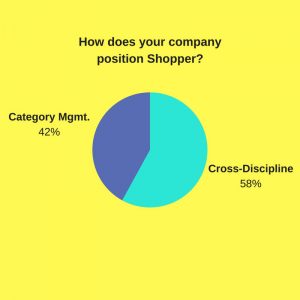

Forty-three percent report “excellent” or “very good” results when Shopper is positioned as a “cross functional strategy that collaborates with Marketing,” compared to 26% when it is positioned as a function of Category Management or Sales. Among those reporting “average” results, 48% are positioned as either “cross functional” or Category Management/Sales.” Of those reporting “not so good” or “poor” results, one percent are “cross functional” and 26% are “category management/sales.”

Thirty-six percent respondents report “excellent” or “very good” results in Shopper regardless of whether the function reports to Sales or Marketing. In organizations where Shopper reports to General Management, 32% said results were “excellent” or “very good.” Among those reporting “average” results, 44% report to Marketing and 50% to Sales.

Fifty percent also reported “average” results among those reporting to General Management. Nineteen percent of those reporting “not so good” or “poor” results reporting to Marketing, 14% to Sales, and 18% to General Management.